QR Code Payment Statistics: Shift in Consumer Behavior in 2025

QR Code Payments is a modern way of completing payments through a simple scan. This mode of payments has undergone exponential growth, especially since the COVID-19 pandemic, illustrating a dramatic shift in consumer behavior.

QR Code is an acronym for Quick Response Code. It's simply a two-dimensional barcode that can be scanned using a smartphone or a QR scanner to quickly extract information or complete a transaction.

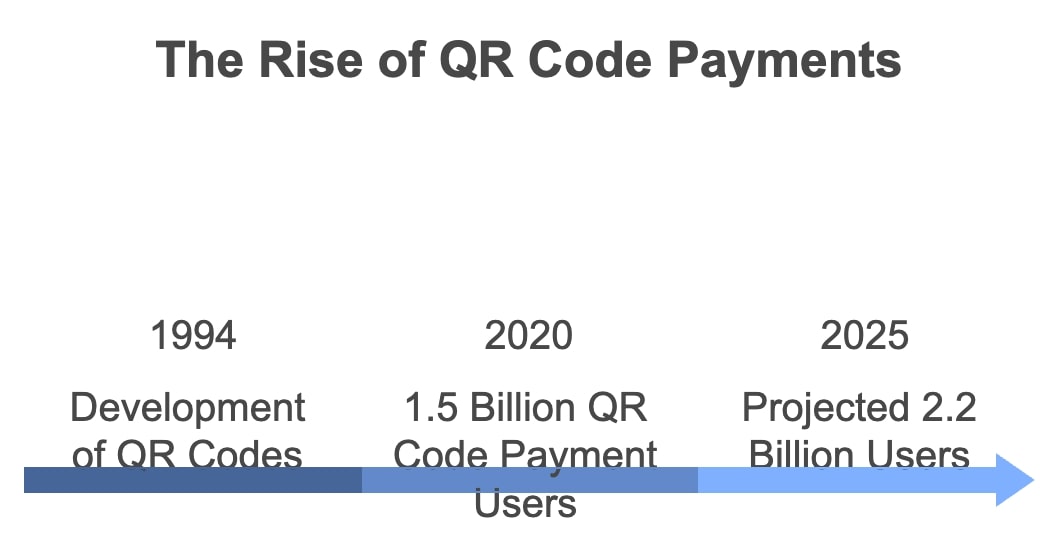

Since their development in 1994, QR codes have found multiple applications, but their usage in payments has become significant in the last few years alone. Today, customers worldwide are growing more comfortable using QR codes for completing payments, and businesses are integrating QR code payments for its simplicity, speed, and affordability.

The shift in consumer behavior with respect to QR code payments has been notable. QR code payment users are expected to surpass 2.2 billion by 2025, up from 1.5 billion in 2020.

The Rising Popularity of QR Codes

The use of QR codes, once considered a novelty, has now become mainstream. Over the past few years, the reach of this innovative technology has extended to every corner of the world, cutting across industries, and firmly anchoring itself into our day-to-day transactions.

The rapid rise in the popularity of QR codes, particularly in payments, can be attributed to several factors. For one, they are remarkably easy to use. With just a smartphone, a user can scan a QR code and instantly complete a payment. This convenience is complemented by the fact that a QR code can contain a lot of information in a small package.

Needless to say, QR Codes are no longer an alien concept. They have become intertwined with our everyday habits, and their value is only set to increase further.

Advantages of QR Code Payments

There's little doubt that QR Code payments are making their mark in the payment sector. The growing fondness for QR code payments is due to a number of advantages it holds over traditional payment methods. Here's a deep dive into what makes QR code payments such a game-changer.

Efficiency and Speed

QR Codes offer unmatched efficiency. Customers just need to hover their smartphone over a QR code to pay, making transactions quick and hassle-free. QR code payments can cut the transaction time down to a matter of seconds, and there is no need for physical cards or cash.

Cost-Effective

Business owners have found QR code payments to be a cost-effective solution. Traditional card-based payment methods involve significant operational costs, including PDQ machines and transaction fees, which can be avoided using QR code payments.

Safety and Security

QR Code payments are a safer alternative to traditional payments as they facilitate contactless transactions. In an era where hygiene and social distancing have become paramount, this feature has only added to the appeal of QR codes. Moreover QR codes use advanced encryption, making them tamper-proof.

As we can see, the shift towards QR code payments is backed by solid benefits that enhance the overall user experience. This user-friendliness and convenience are reshaping the consumer behavior around payments.

Influence of COVID-19 on QR Code Usage

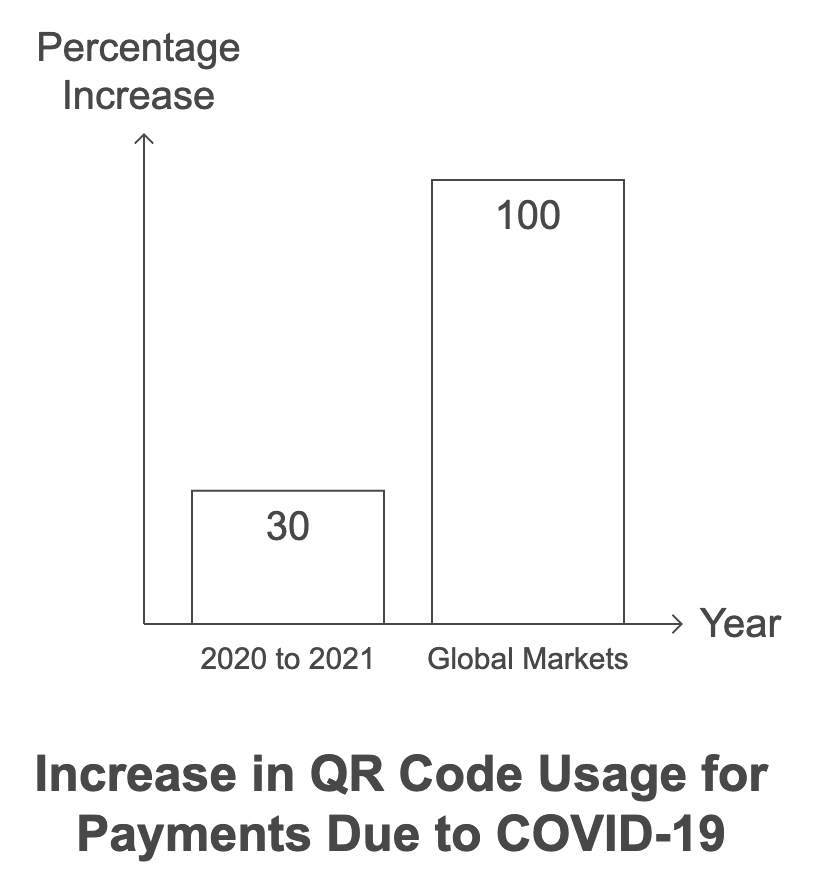

COVID-19 has had a profound impact on all aspects of life, including how we handle payments. With the pandemic pushing people towards contactless transactions, QR Code Payments have seen a significant boost in usage.

This shift has been unprecedented and swift. As noted in a statistics report by Juniper Research, the number of consumers leveraging QR codes for payments will surge by nearly 30% in 2021 compared to 2020. Meanwhile, many global markets have even reported a doubling of QR code use during the pandemic.

Contactless payments, like QR code payments, offer a safer, cleaner alternative to cash or card transactions, which can be hotspots for virus transmission. This outbreak might have triggered the initial pivot to QR codes, but consumers appear to be experiencing and valuing the convenience, efficiency, and safety it provides, making it more likely for the trend to continue post-pandemic.

It's evident that the impact of COVID-19 has accelerated the adoption of QR codes in everyday payments, signalling a shift in consumer behavior towards contactless transactions.

How QR Codes are Changing Consumer Behavior

QR codes are revolutionizing payments and changing consumer behavior around the globe. Adoption of this technology is widening, and the reasons are multifold. The ability to make swift, simple and secure transactions is driving more and more consumers to use QR code payments over traditional methods.

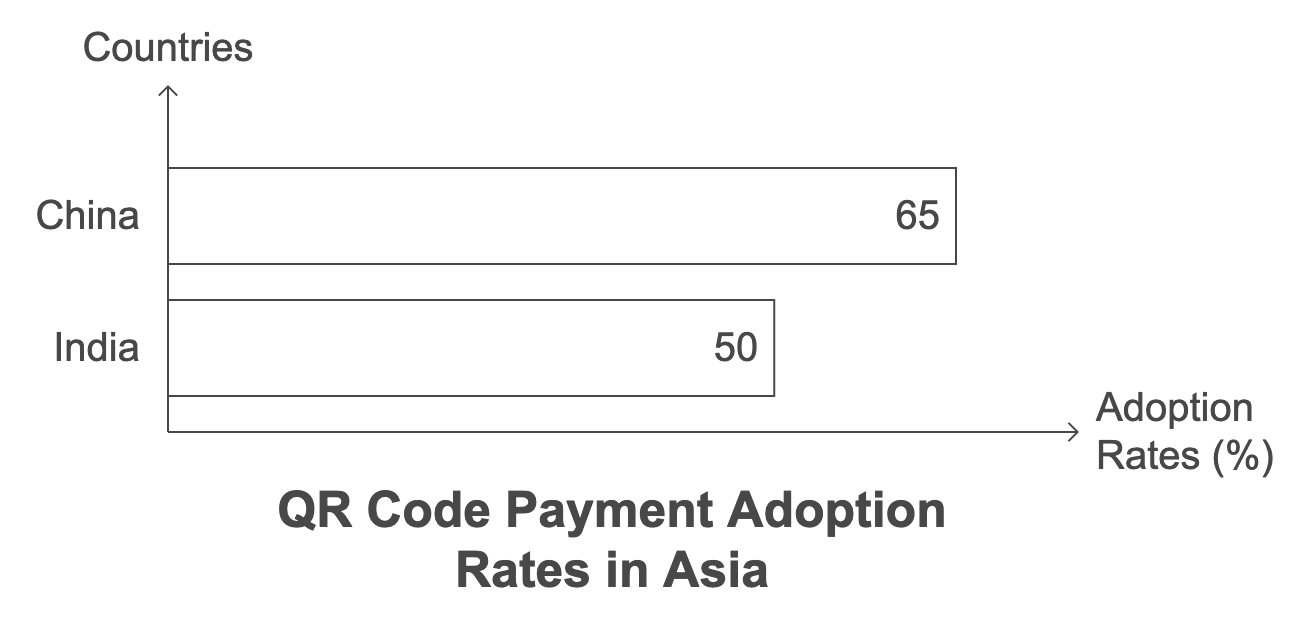

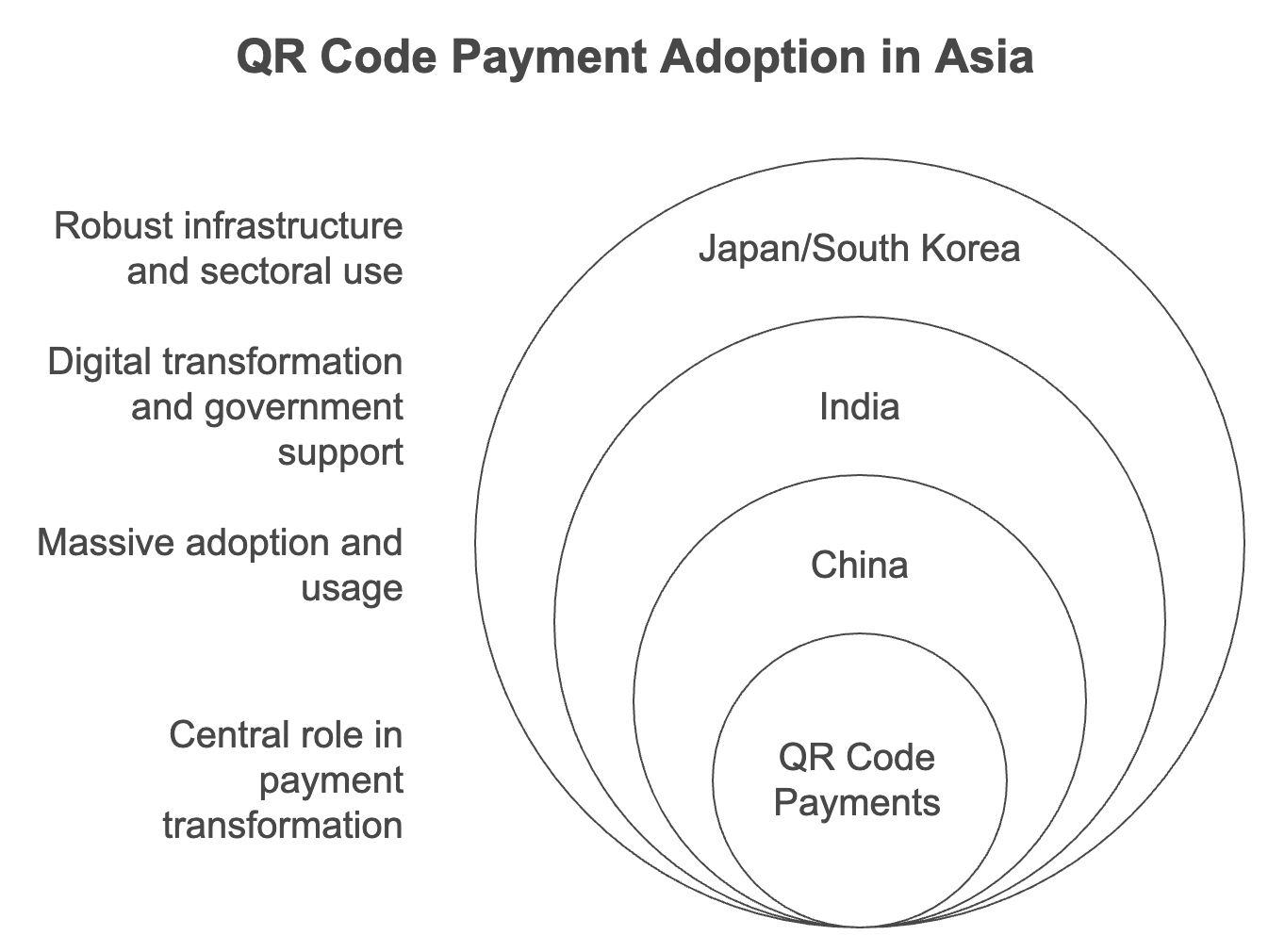

A case in point is the change seen in consumer behavior in Asia, where QR codes reign supreme for daily payments. China and India saw over 65% and 50% of mobile users, respectively, using QR codes for payments annually. This clearly demonstrates a major shift in the way consumers are choosing to make their payments.

Not only are QR codes a safer alternative given the current global health crisis, but they also deliver an enhanced user experience by seamlessly integrating with digital wallets and banking apps. Convenience and speed are highly valued in today's fast-paced society, and by enabling that, QR codes are shaping how consumers transact.

In summary, QR codes are rewriting the rules of the payment landscape, and as adoption rates rise, we can foresee a future where QR codes become the norm rather than the exception.

Potential Future of QR Code Payments

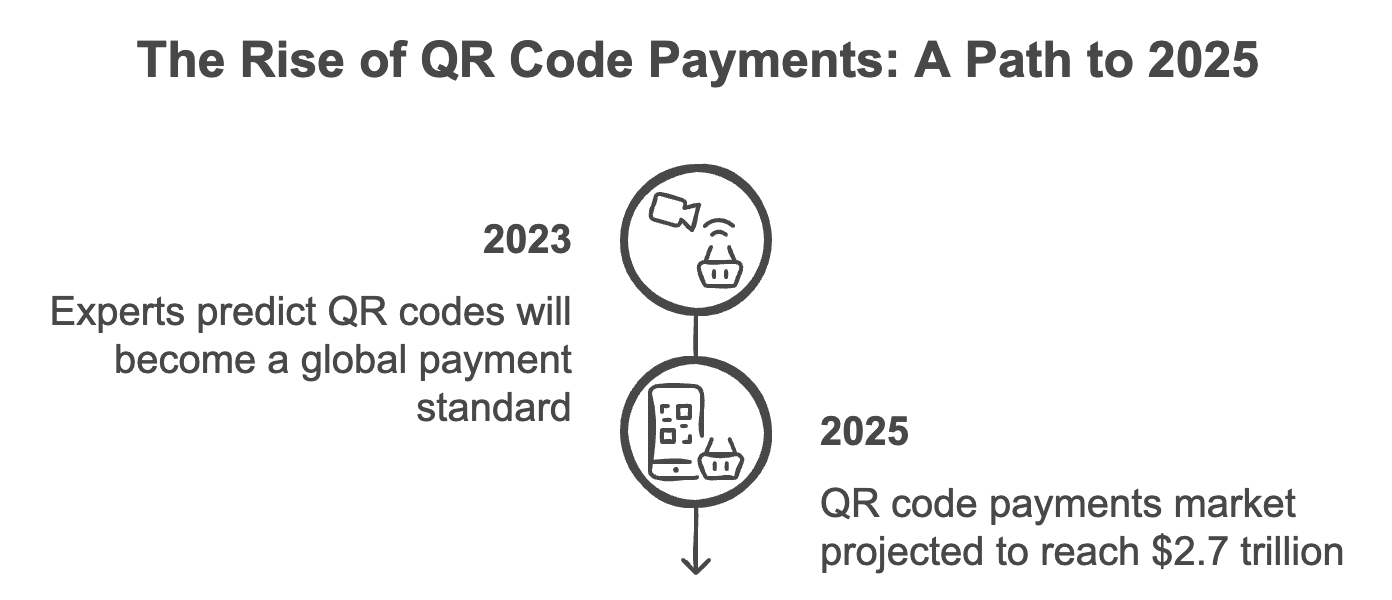

As we observe the rising trends and statistical data, we can confidently say that the future of QR code payments looks promising. Experts predict that QR codes are poised to become a globally accepted contactless payment methodology, backed by the simplicity and efficiency they offer.

The adoption rate is expected to surge in the coming years. Global QR code payments market is estimated to grow at 12.8% per annum, and expected to reach $2.7 trillion by 2025.

Besides, tech giants like Google and Apple are driving this adoption by introducing QR code scanning in their camera applications, making it easier for consumers.

However, it's crucial to overcome certain challenges to completely integrate this technology into our everyday payments. The first is to ensure the privacy and security of these payments. The other is improving the familiarity and comfort of users with QR code scanning and payments.

Given the present trajectory, we can envision a future where QR codes become the dominant form of contactless payment, driving the next instance of digital innovation.

Market-Specific Analysis: A Closer Look at Asia

In the conversation about QR Code payments, it's impossible to ignore their extensive usage and popularity in the Asian market. Covering diverse economies from highly digital regions like China and Singapore to emerging markets like India and Vietnam, Asia provides a fascinating study in the rapid acceptance and development of QR code payment systems.

China: Leading the QR Code Revolution

China's embrace of QR Code payments is massive. The technology is so widespread in China that even street vendors support QR code transactions. Overwhelming number of mobile users in the country use QR codes for payment every year.

India: The Digital Payment Transformation

India, another rapidly growing economy, is also experiencing extensive usage of QR Code payments. Government initiatives promoting digital transactions, combined with the accessibility and efficiency of QR codes, has led to high adoption levels.

Japan and South Korea: Robust Digital Infrastructure

With robust digital payment infrastructure, countries like Japan and South Korea have also seen notable adoption of QR code payments. This can be seen in a variety of sectors including retail, transportation, and food service.

These examples clearly illustrate the growing trend towards QR code payments in Asia and their potential for global expansion. Thus, the market-specific analysis fortifies the argument that QR code payments are reshaping consumer behavior and transforming the payment landscape.

Overcoming Challenges in QR Code Payments

While QR Code Payments present a myriad of advantages and potential for future growth, there are certain challenges that need to be overcome. Two of the main hurdles include ensuring data privacy and raising user familiarity and trust.

Data Privacy

While QR code payments are generally safe and secure, the risk of phishing attacks and data leaks exists. A well-designed fake QR code can lead to unsafe websites or trigger downloads of malware. Users need to be assured that their payment information is treated with utmost security.

With technological advancements, businesses are deploying advanced encryption technologies to prevent such breaches. Additionally, consumer education on spotting fake QR codes can significantly reduce the risk. QRCode.co.uk provides safe and reliable QR code transactions, actively ensuring security at every step.

User Familiarity and Trust

Trust in digital payments is dependent on understanding of the technology. Improving familiarity with QR code scanning and payments is crucial in encouraging its wider acceptance. This involves investing in customer education and awareness.

Technological solutions can solve these challenges. With consistent efforts from payment distributors, businesses, and governments, QR codes can become a more secure and universally accepted method of payments, contributing to a significant shift in consumer behavior.

Conclusion

The growth of QR Code Payments has been impressive, and recent statistics indicate a substantial shift in consumer behavior favoring this technology. The efficiency, security, cost-effectiveness, and contactless nature of QR codes have greatly contributed to this change. The dramatic increase in adoption triggered by the COVID-19 pandemic showcases the potential of QR codes as a mainstream method of payment in the future.

However, overcoming challenges like data privacy concerns and improving user familiarity and trust are crucial in leveraging the full potential of this technology. With consistent efforts from businesses, payment platform providers, and governments, QR codes are well on their way to revolutionizing the landscape of digital payments.

This shift towards QR code payments is a clear indication of the continual evolution and advancement of our society. As we embrace this technology, we find ourselves stepping into the future of payments, today.

I hope this helps elevate your understanding of how the usage of QR codes has generated a notable shift in consumer behavior and how it shapes the future. As technology advances, we can only anticipate more such revolutionary changes ahead.

Stay tuned for more insights and updates. And don't forget, next time you make a payment, consider QR codes - it's fast, it's safe, and it's the future!

Frequently Asked Questions

1. What is a QR Code Payment?

A QR Code Payment is a contactless payment method that allows users to complete a transaction simply by scanning a QR code using a smartphone or a QR scanner. The adoption of QR code payments has risen dramatically, especially during the COVID-19 pandemic.

2. Why Are QR Code Payments Becoming Popular?

The popularity of QR code payments is driven by multiple factors - they're efficient, cost-effective, and promote hygiene through contactless transactions. The shift towards QR codes was especially pronounced during the COVID-19 pandemic, where minimizing contact became paramount.

3. How Are QR Codes Changing Consumer Behavior?

As more users experience the convenience, speed, and safety of QR code payments, there's a clear shift in consumer preference towards this mode of transaction. Especially in Asia, a substantial number of mobile users now favor QR codes for payments annually.

4. What Does the Future Hold for QR Code Payments?

Experts anticipate QR codes becoming a globally accepted contactless payment methodology. The estimated global QR code payments market size is predicted to reach $2.7 trillion by 2025, marking a steady annual growth rate.

5. What are the Challenges Facing QR Code Payments?

While QR code payments have numerous advantages, potential challenges include ensuring data privacy and raising user familiarity and trust. It's crucial to reinforce safety protocols and educate users properly to encourage broader acceptance.

United Kingdom QR Code Usage Trends 2024