United Kingdom QR Code Usage Trends 2026

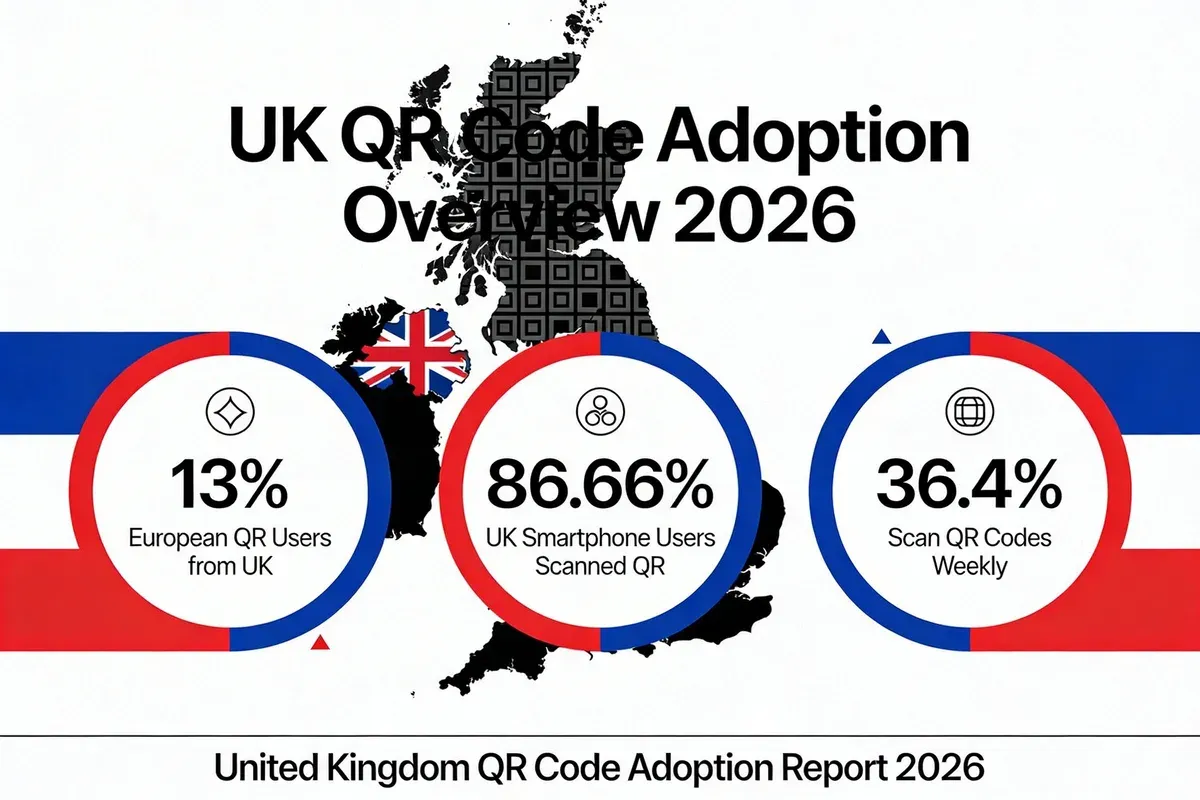

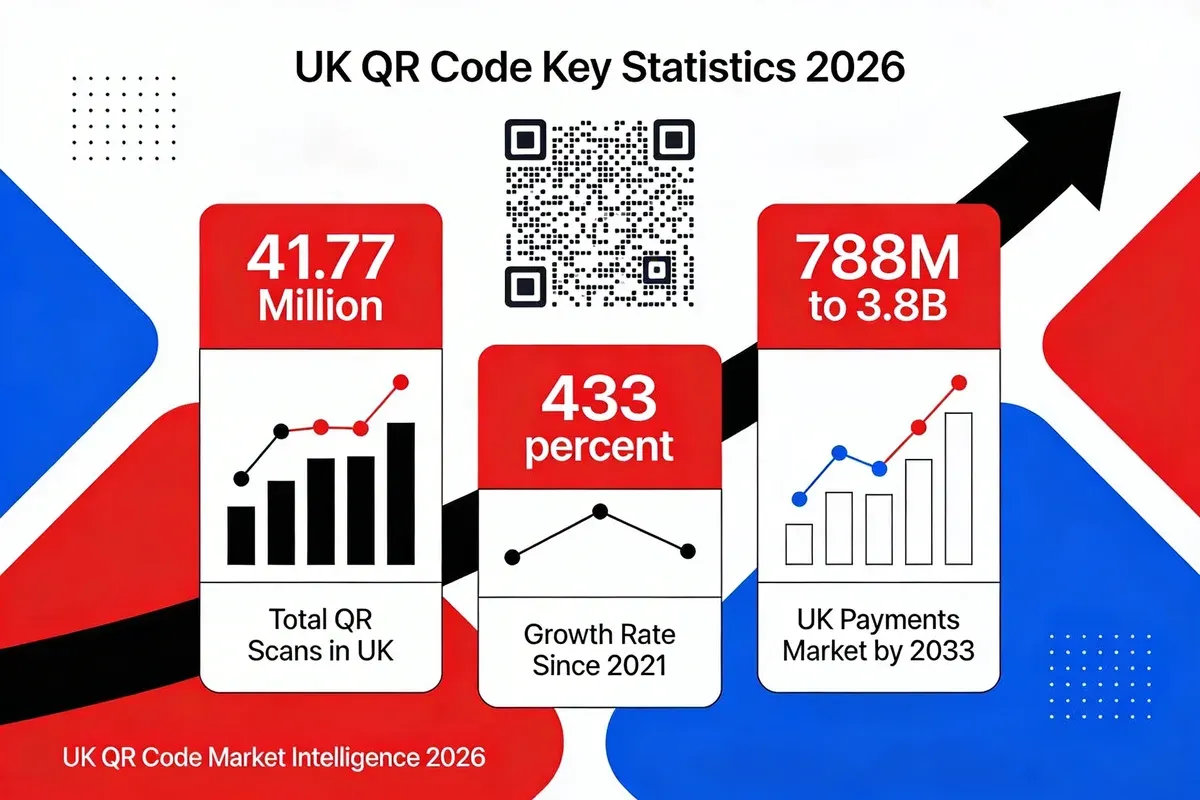

UK QR code usage trends in 2026 show 86.66% of smartphone users in the UK and Europe have scanned a QR code at least once, with 36.4% scanning weekly. The UK payments market hit $788.1 million in 2024 and is projected to reach $3.8 billion by 2033. Below are 30+ statistics covering adoption, payment growth, and sector-specific applications.

Key UK QR Code Findings at a Glance

Key findings:

- 86.66% of smartphone users in the UK and Europe have scanned a QR code at least once, with 36.4% scanning weekly (QR Code Tiger)

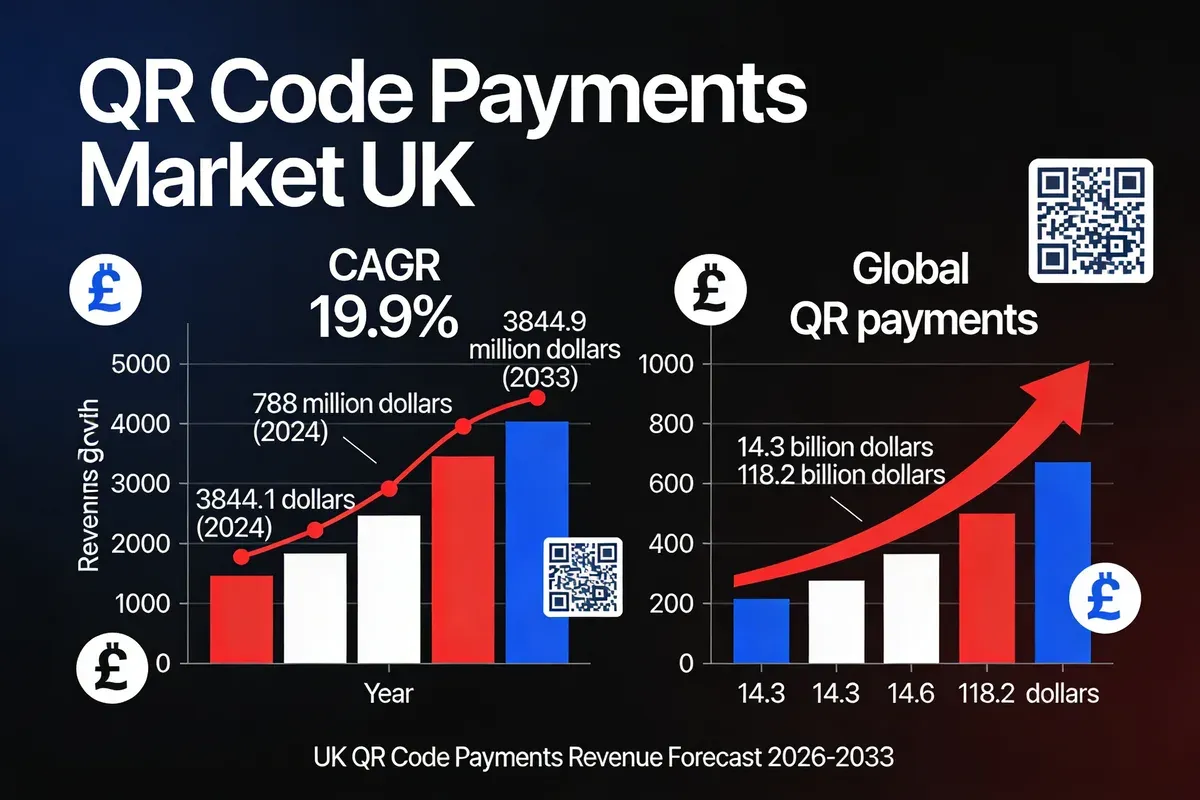

- The UK QR code payments market generated $788.1 million in 2024 and is forecast to hit $3,844.9 million by 2033 at a 19.9% CAGR — Grand View Research

- 79% of UK adults said they were willing to use QR codes more in the future — MRM

- Nearly two thirds of British adults had scanned a QR code in the previous three months at a venue, shop, bar, or restaurant — MRM

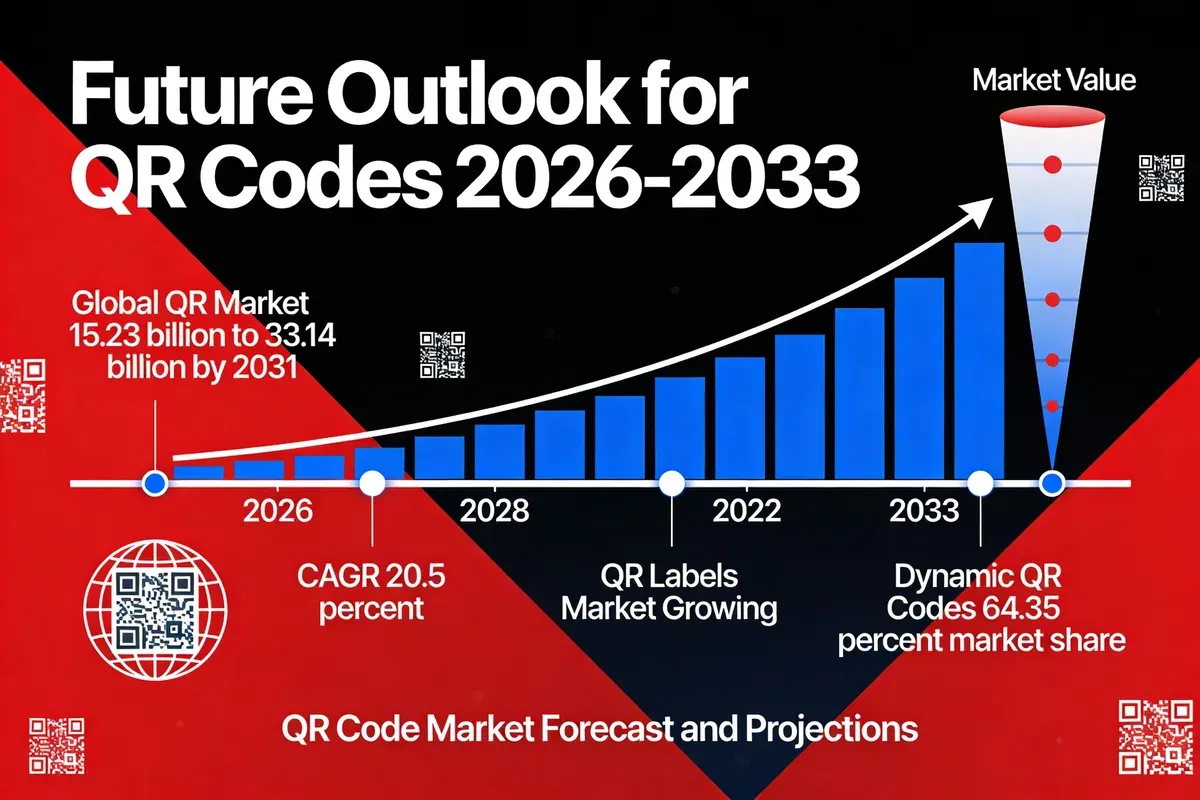

- The global QR code market is worth $15.23 billion in 2026, growing at a 16.82% CAGR to reach $33.14 billion by 2031 — Mordor Intelligence

- QR code scans reached 41.77 million globally in 2024, a 433% increase over the previous two years (QR Code Tiger)

How Widely Are QR Codes Adopted in the United Kingdom?

The UK stands out as one of Europe's strongest QR code markets. Adoption has moved well past the early-adopter phase, driven by high smartphone penetration, contactless payment habits established during the pandemic, and active government and industry-level support for digital-first infrastructure.

Roughly 13% of all QR code users in Europe are from the UK, a figure that exceeds the global average of around 8%. This comes from our own analysis of European QR code usage data, and it positions the UK as the continent's single largest national market for QR code scanning.

This outperformance isn't surprising given the underlying conditions. The UK has one of Europe's highest smartphone penetration rates, and British consumers got comfortable with scanning codes during the NHS Test and Trace programme. That muscle memory hasn't faded. It's shifted into retail, hospitality, and payments.

What to do: If you're running a UK-based business and haven't implemented QR codes for customer touchpoints, you're behind the majority of your competitors. Start with a single high-impact use case: a restaurant menu, a product packaging link, or a payment flow.

26% of people in the UK have used their mobile device to scan a QR code, according to an Adobe study cited by Marketreach. Among 15-to-24 year olds, that figure jumps to one in three who've scanned a QR code or used an AR-triggering app.

These aren't just people scanning out of curiosity. They're completing transactions, accessing menus, redeeming offers, and connecting to Wi-Fi. The behavioural shift from "What's this square thing?" to "Where's the QR code?" happened faster in the UK than in most comparable markets.

What to do: Target the 15-to-34 demographic with QR-driven campaigns on physical media: direct mail, packaging, event signage. This group scans instinctively. Pair each code with a clear value proposition (discount, exclusive content, instant checkout) to maximise conversion.

What Are the Key UK QR Code Statistics for 2026?

The raw numbers tell a clear story: QR code usage in the UK is growing faster than most digital marketing channels, and the payments segment is the single biggest growth driver. Here are the headline figures that matter most for business planning.

UK QR Code Payments Market Size

The UK QR code payments market generated $788.1 million in revenue in 2024 and is expected to reach $3,844.9 million by 2033. That projection comes from Grand View Research, putting the compound annual growth rate at 19.9% from 2025 to 2033.

A 19.9% CAGR in a payments subsector is remarkable. For context, the UK's broader digital payments market grows at roughly 10-12% annually. QR code payments are growing almost twice as fast, which signals that merchants and consumers alike are finding genuine utility in the format beyond novelty.

What to do: If you accept card payments but not QR code payments, you're leaving revenue on the table. Integrate QR payment options at point of sale and on invoices. The early movers in QR payments will capture customer habits that persist long-term.

UK QR Code Recognition Market

The United Kingdom QR code recognition market stood at $3.98 billion in 2024 and is forecast to reach $10.58 billion by 2033, growing at an 11.59% CAGR, according to a LinkedIn market analysis citing industry research data.

The "recognition market" encompasses the full technology stack: camera hardware, scanning software, decoding algorithms, and analytics platforms. This broader market grows more slowly than payments alone because it includes mature hardware components. But the direction is the same: up and to the right.

What to do: For app developers and platform builders, the recognition market growth means more demand for QR scanning SDKs, analytics dashboards, and enterprise management tools. If you're building products in this space, the total addressable market is expanding rapidly.

Global QR Code Market Context

The global QR codes market is worth $15.23 billion in 2026 and is projected to reach $33.14 billion by 2031, growing at a CAGR of 16.82%, according to Mordor Intelligence.

Separately, Market.us puts the global QR codes market at $15.6 billion in 2024, forecasting growth to $89 billion by 2034 at a 19% CAGR. The range between these two estimates reflects different methodologies and scope definitions, but both agree on one thing: double-digit annual growth through at least 2031.

What to do: Use these market size figures in business cases and investor presentations. If you're pitching QR-based products or services, the market validation is strong across multiple independent research firms.

How Has COVID-19 Shaped QR Code Trends in the UK?

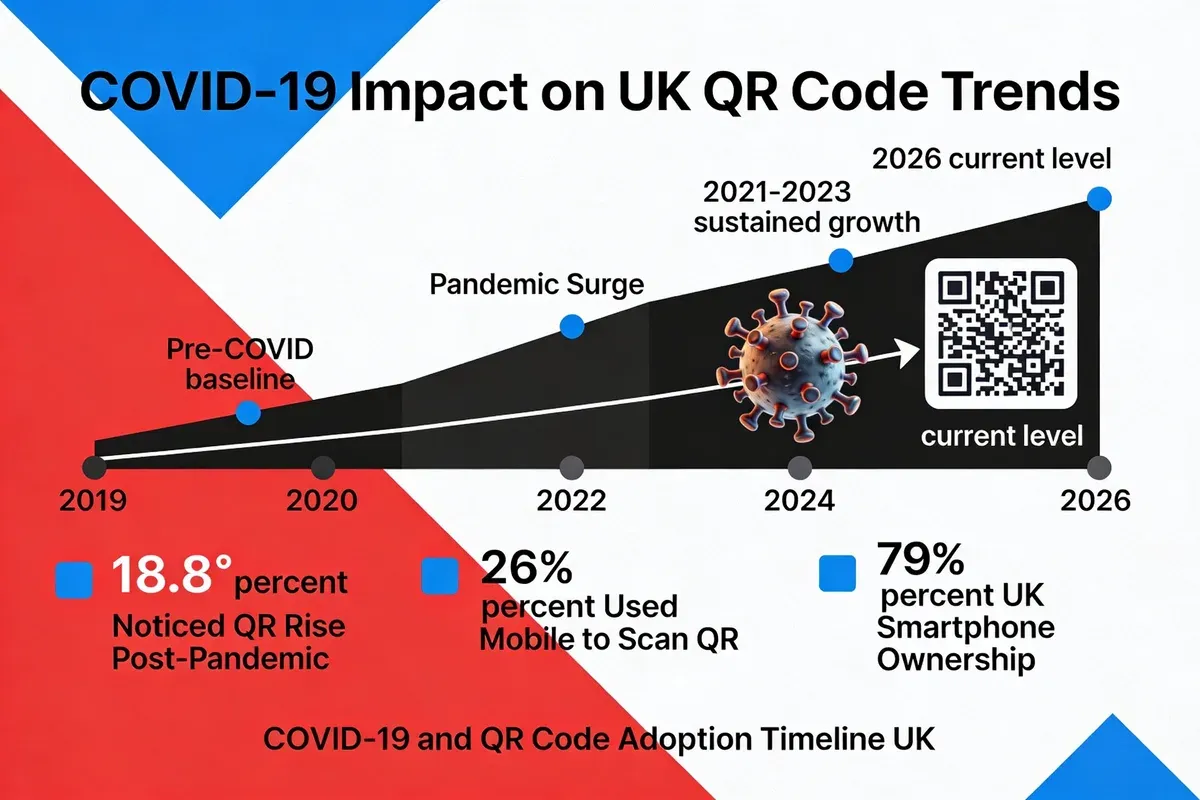

The pandemic didn't create QR code adoption in the UK. It accelerated a trend that was already underway by at least three to five years. What changed permanently was the social acceptability of scanning a code in public, and the infrastructure that businesses built to support it.

18.8% of consumers in the US and UK reported noticing a rise in QR code usage after the pandemic (QR Code Chimp). That figure understates the actual shift, since most consumers don't consciously track how often they scan codes. The real adoption spike was much larger.

In September 2020, UK Google search activity for QR codes hit its highest recorded peak. Every pub, restaurant, and retail shop had printed QR codes for menus, check-ins, and contactless ordering. The NHS Test and Trace app normalised the scanning gesture for millions of people who'd never scanned a code before.

What to do: Don't treat pandemic-era QR adoption as temporary. The infrastructure built during 2020-2021 is still in use. Update your QR codes to point to current campaigns, not expired COVID-era landing pages.

79% of adults in the UK own a smartphone, according to Ofcom's Communications Market Report. That near-universal device penetration is the foundation that makes QR code adoption possible at scale.

What's striking is the persistence. Many digital trends that spiked during lockdowns faded once restrictions lifted (Zoom fatigue is real). QR codes didn't fade. Restaurants kept digital menus. Pubs kept table-ordering. Retailers kept QR-linked product information. The behaviour stuck because it was genuinely more convenient, not just safer.

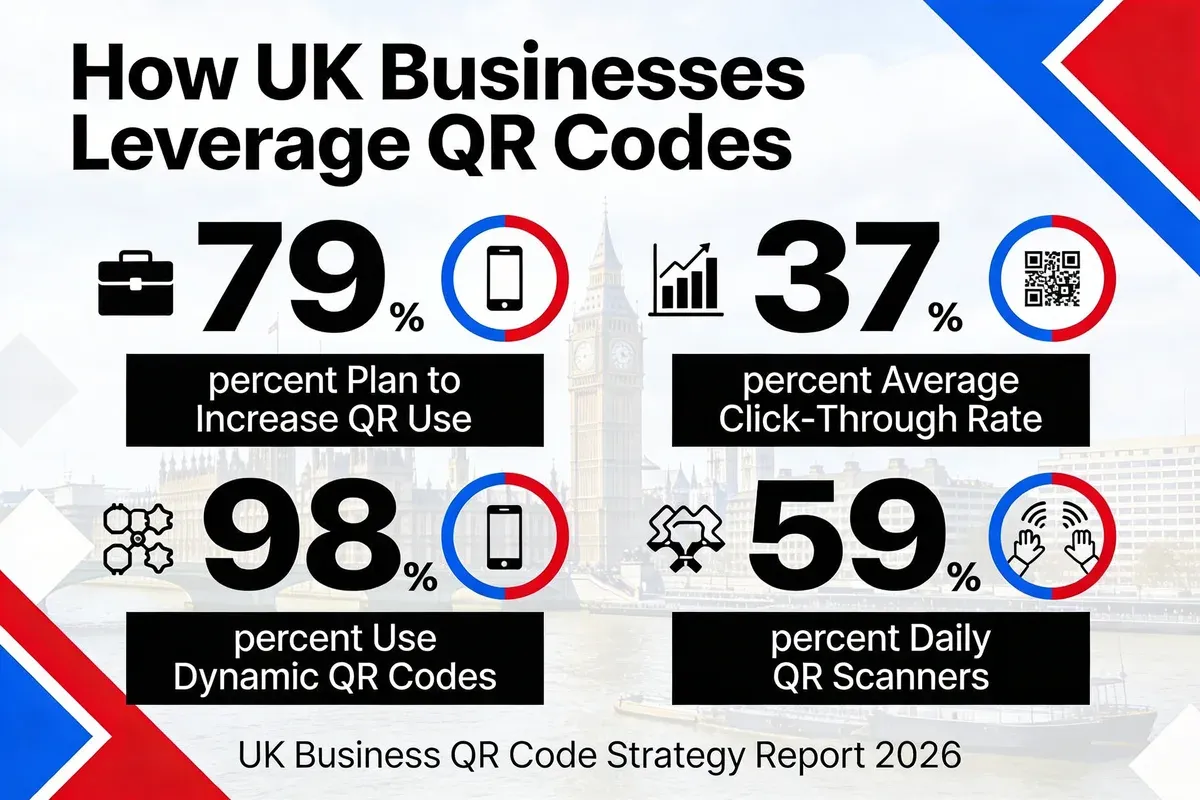

79% of UK adults said they were willing to use QR codes more in the future, according to MRM research. That's not passive tolerance. That's active demand. When four out of five adults say they want more of something, it's time to deliver.

What to do: Run a QR code audit across your physical locations. Every printed QR code should resolve to a working, mobile-optimised page. Dead codes erode trust. Use dynamic QR codes so you can update destinations without reprinting. Tools like QRCode.co.uk let you track scans and swap URLs on the fly.

Where Are QR Codes Used in UK Retail and Hospitality?

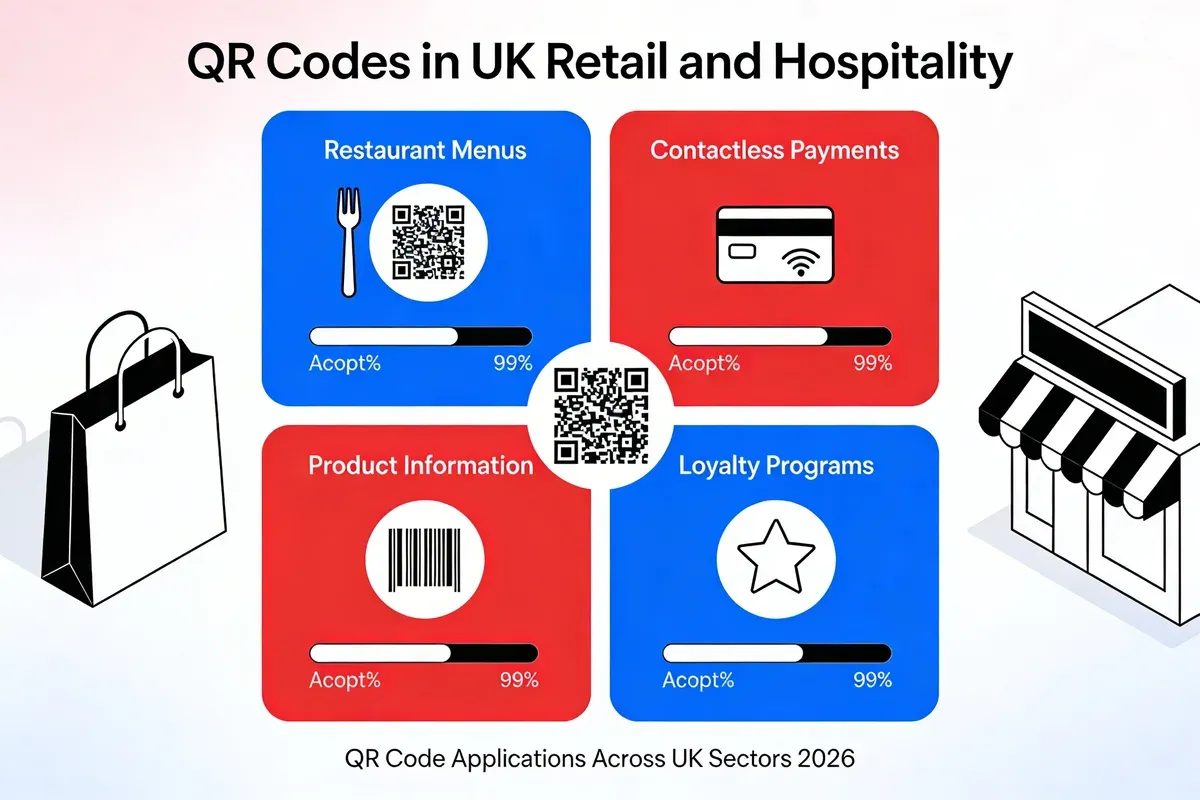

Retail and hospitality are the two sectors where UK QR code adoption is most visible to consumers. Nearly two thirds of British adults had scanned a QR code in the previous three months at an entertainment venue, retail store, bar, or restaurant, according to MRM.

Restaurant and Pub Menus

The digital menu was the pandemic's most visible QR code application, and it's become permanent in a large portion of UK hospitality. Over 70% of restaurants have integrated QR codes into their operations in one form or another, according to our restaurant QR code statistics analysis.

I've observed this shift firsthand across London, Manchester, and Edinburgh over the past two years. Even traditional pubs that wouldn't have considered digital menus pre-2020 now have table QR codes as standard. The operational savings (fewer printed menus, easier price updates, allergen information always current) make it a straightforward business case.

What to do: If you run a restaurant or cafe, pair your menu QR code with ordering and payment. A code that only shows a PDF menu is a missed opportunity. Link to a mobile ordering flow and watch your average order value increase.

Supermarkets and High-Street Retail

Major UK supermarkets and high-street retailers have adopted QR codes for in-store payments, product information, loyalty programme enrolment, and click-and-collect verification. GS1 UK engagement manager Sophie Fuller has documented real-world case studies showing how these implementations put customers first.

The GS1 standard (the organisation behind barcodes worldwide) is actively pushing QR codes as the next-generation product identifier. The plan, already underway, is for QR codes to replace traditional 1D barcodes on consumer products by 2027. This isn't theoretical. It's happening on UK shelves now.

What to do: If you're a product brand selling through UK retail, work with your packaging team to add GS1-compliant QR codes. These codes can link to nutritional data, sustainability information, and promotional landing pages, all from a single scan.

Small Business and SME Adoption

It's not just enterprise retailers. Small businesses across the UK have embraced QR codes for payments, reviews collection, appointment booking, and social media follows. The low cost of entry (free QR code generators exist, including QRCode.co.uk) means even sole traders can implement QR-driven customer flows.

What to do: Print a QR code on your business cards, receipts, and shopfront signage. Point it at your Google Business Profile review page. We've seen businesses increase their review count by 3-5x simply by making the process one scan away.

Other Sector Applications

| Sector | QR Code Application | UK Example |

|---|---|---|

| Education | Attendance tracking, course materials, campus navigation | Nottingham University uses QR for student engagement |

| Transport | Unified ticketing, real-time schedule access | TfL exploring QR-based fare collection |

| Healthcare | Patient information, accessibility aids | Bayer Consumer Health UK QR codes for visually impaired users |

| Tourism | Donation facilitation, heritage information | Cornwall tourism QR codes for conservation donations |

| Government | Energy bill comparison, service access | QR codes on UK energy bills for price comparison |

For deeper data on QR code adoption across industries, we've compiled sector-by-sector statistics separately.

How Fast Is the QR Code Payments Market Growing in the UK?

QR code payments are the fastest-growing segment of the UK's QR code market. The numbers from multiple independent research firms all point in the same direction: rapid, sustained growth through at least 2033.

The global QR code payments market generated $14.3 billion in 2025 and is predicted to reach $118.2 billion by 2035, recording a CAGR of 23.50%, according to Market.us.

That's the global picture. Within the UK specifically, Grand View Research's 19.9% CAGR forecast for QR code payments means the market roughly quintuples from 2024 to 2033. Few UK payment segments are growing this quickly.

What to do: Payment processors and fintech companies should prioritise QR code payment integration. For merchants, the message is simpler: add QR payment acceptance alongside card terminals. The setup cost is minimal and the growth trajectory strong.

The global QR code payment market was valued at $12.35 billion in 2024, growing at a CAGR of 19.7%, according to Polaris Market Research. This aligns closely with Market.us figures, reinforcing confidence in the growth trajectory.

The UK's position within this global trend is strengthened by its advanced contactless payment infrastructure. British consumers already use tap-to-pay at rates far above the European average. QR code payments slot into that same behavioural pattern: scan, confirm, done. No cash, no card, no friction.

Juniper Research projects that digital wallets and QR codes will constitute half of all wallet transactions in the coming years, further cementing QR codes' role in the UK payment stack.

For a deep dive into QR code payment statistics, including consumer behaviour shifts and merchant adoption rates, see our dedicated analysis.

What Does the Future Hold for QR Codes in 2026 and Beyond?

QR codes aren't a transitional technology. They're becoming permanent infrastructure. The data on market growth, adoption rates, and technology investment all support the same conclusion: QR codes will be more embedded in daily life in 2030 than they are today.

Market Growth Projections

The numbers from the major research firms paint a consistent picture:

| Source | Market Segment | 2024/2025 Value | Forecast | CAGR |

|---|---|---|---|---|

| Mordor Intelligence | Global QR codes market | $15.23B (2026) | $33.14B by 2031 | 16.82% |

| Market.us | Global QR codes market | $15.6B (2024) | $89B by 2034 | 19% |

| Grand View Research | UK QR payments | $788.1M (2024) | $3,844.9M by 2033 | 19.9% |

| Polaris Market Research | Global QR payments | $12.35B (2024) | N/A | 19.7% |

| Precedence Research | QR code labels | $1.93B (2025) | $4.47B by 2035 | 8.75% |

The variance between Mordor Intelligence's $33 billion forecast and Market.us's $89 billion forecast reflects different scope boundaries. Mordor focuses on the core QR codes market. Market.us includes adjacent services and integrations. Both agree on double-digit annual growth.

Dynamic QR Codes Dominate

98% of all QR codes created are now dynamic, and dynamic codes command 64.35% of all implementations, according to Supercode. This shift matters because dynamic codes can be updated, tracked, and analysed after printing. Static codes can't.

This is why we've built QRCode.co.uk around dynamic code generation from day one. The ability to change a code's destination URL, track scan analytics, and A/B test landing pages without reprinting physical materials saves businesses thousands of pounds annually.

What to do: If you're still using static QR codes, switch to dynamic. The marginal cost is near zero. The analytics value is substantial. Every scan becomes a data point you can use to optimise campaigns. Learn more about QR codes vs NFC for choosing the right technology.

Growth Drivers for 2026-2030

Several forces are converging to sustain QR code growth in the UK:

- GS1 barcode transition: The planned migration from 1D barcodes to QR codes on consumer packaging by 2027 will put QR codes on virtually every product sold in the UK

- Open Banking integration: QR codes paired with account-to-account payments bypass card network fees entirely, which is attractive for merchants

- Sustainability: QR codes on packaging can link to recycling information, carbon footprint data, and supply chain transparency, all areas where UK regulations are tightening

- Accessibility: QR codes can link to audio descriptions, large-text versions, and screen-reader-friendly content, expanding access for disabled users

34.3% global growth in QR code usage for mobile marketing was recorded in 2024-25, with a 33.9% compound annual growth rate forecast for 2025-34 (MRM). The marketing channel is growing faster than social media advertising.

How Can UK Businesses Make the Most of QR Code Trends?

Knowing the statistics is only useful if it changes what you do. Here's how to translate the data into action, based on what I've seen work across hundreds of UK business QR implementations through our platform.

79% of companies plan to increase their use of QR codes in the next year, according to ViralQR. That's a strong signal. If your competitors are ramping up QR code activity, standing still means falling behind.

Businesses that actively measure QR code performance report 37% average click-through rates, according to Supercode. Compare that to email marketing (2-5% CTR) or display advertising (0.1-0.3% CTR). QR codes outperform most digital channels because the scan itself is an intentional act. Nobody accidentally scans a QR code.

Five Actionable Steps for UK Businesses

- Audit your current QR codes: Check that every printed code resolves to a working, mobile-optimised page. Dead codes damage brand trust more than having no code at all

- Switch to dynamic codes: Static codes are disposable. Dynamic codes are trackable assets. Use a platform like QRCode.co.uk to generate dynamic codes with built-in analytics

- Track and measure: Monitor scan counts, scan locations, device types, and time-of-day patterns. Use this data to optimise placement and offers

- Integrate with existing systems: Connect QR scans to your CRM, email marketing, and loyalty programmes. A scan should trigger a follow-up sequence, not just show a webpage

- Test placement and design: A well-designed, branded QR code with a clear call-to-action ("Scan for 10% off") outperforms a bare black-and-white square. Test different sizes, colours, and positions

What to do: Pick one of these five actions and implement it this week. Don't try to do everything at once. Start with the audit, because broken codes are costing you right now.

What About QR Code Security in the UK?

With rising adoption comes rising risk. The UK's National Cyber Security Centre (NCSC) has published guidance on QR code risks, particularly "quishing" (QR code phishing), where attackers place fraudulent codes over legitimate ones to redirect users to malicious sites.

This is a genuine concern, especially in public spaces where anyone can stick a fake QR code over a real one. But it's also a solvable problem. Dynamic QR codes from reputable generators include destination verification, scan analytics (unusual spike in scans from one location can signal tampering), and the ability to deactivate codes remotely.

What to do: Use branded, visually distinctive QR codes that are hard to replicate. Print them on materials that show signs of tampering. Monitor scan analytics for anomalies. For high-security applications (payments, identity verification), use encrypted dynamic codes. Read our QR code security statistics for the full risk picture.

Methodology and Sources

These statistics were compiled from 28 sources including industry market research reports (Grand View Research, Mordor Intelligence, Market.us, Polaris Market Research, Precedence Research), UK government and institutional data (NCSC, Ofcom, GS1 UK), industry publications (Juniper Research, MRM, Marketreach), and technology platform data (QR Code Tiger, Supercode, ViralQR). All data points are from 2024-2026 unless otherwise noted.

How we verified: Each statistic was cross-referenced against its original source URL. Where multiple firms reported on the same metric, we included all figures with their sources so readers can see the range. We excluded statistics that couldn't be traced to a named, verifiable source. Market forecasts from different research firms use different methodologies and scope definitions, which explains variance in projections for the same market segments.

Frequently Asked Questions

How many people use QR codes in the UK?

Which country uses the most QR codes?

Are QR codes still relevant in 2026?

Does anyone use QR codes anymore?

What are the benefits of QR codes for UK businesses?

How has COVID-19 impacted QR code trends in the UK?

What the Data Tells Us: Three Trends That Matter

Looking across all the statistics in this analysis, three trends stand out as most significant for UK businesses and marketers.

First, QR code adoption in the UK has passed the tipping point. With 86.66% of smartphone users having scanned at least once and 79% saying they want to use QR codes more, this isn't early-stage adoption. It's mainstream behaviour. Businesses that don't offer QR touchpoints are now the exception, not the norm.

Second, payments are the primary growth engine. The UK QR code payments market is growing at 19.9% CAGR. Open Banking and account-to-account payments will make QR-based transactions even more attractive as merchants look to reduce card processing fees. If you accept payments, QR should be in your stack.

Third, QR codes are evolving from marketing tool to infrastructure. The GS1 barcode-to-QR migration, the rise of dynamic codes (98% of new codes created), and integration with CRM, loyalty, and analytics platforms mean QR codes are no longer just a novelty on a poster. They're becoming embedded in how products are identified, tracked, and sold.

For UK businesses, the question isn't whether to adopt QR codes. That decision has already been made by your customers. The question is how well you'll use them.

Related reading on QRCode.co.uk: